Unveiling the Truth Behind Financial Ties

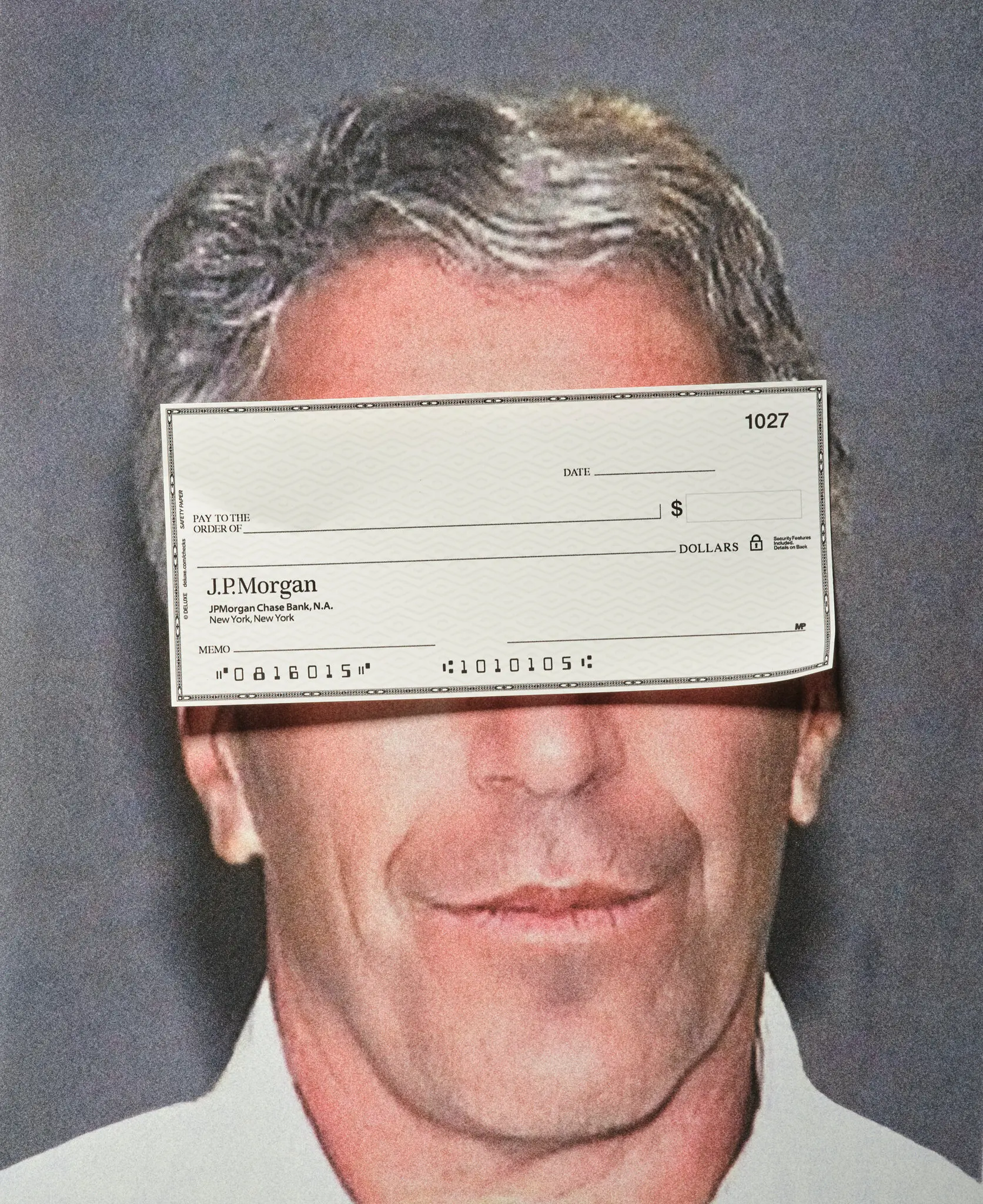

JP Morgan and Epstein: A Deep Dive

Explore the intricate connections between JP Morgan and Jeffrey Epstein, uncovering the financial dealings and implications that have come to light.

As discovered by the New York Times

The Complex Web of JP Morgan and Epstein

The relationship between JP Morgan and Jeffrey Epstein has been a subject of intense scrutiny. The article delves into how the financial giant allegedly facilitated Epstein’s illicit activities by providing him with banking services despite his criminal record. Key points include the bank’s internal discussions about Epstein’s accounts and the subsequent legal and reputational challenges faced by JP Morgan. This overview sheds light on the broader implications for financial institutions and their role in monitoring client activities.

Furthermore, the article highlights the legal battles that have ensued as victims seek justice and accountability. It raises questions about corporate responsibility and the ethical obligations of financial entities in preventing the misuse of their services. The narrative is a stark reminder of the need for stringent compliance measures and the potential consequences of neglecting them.

Key Allegations Against JP Morgan

Facilitating Financial Transactions

JP Morgan is accused of enabling Epstein’s criminal activities by allowing him to conduct financial transactions that supported his operations, despite awareness of his criminal history.

Ignoring Red Flags

The bank allegedly overlooked numerous red flags and internal warnings regarding Epstein’s accounts, raising questions about its compliance practices and risk management.

Legal and Reputational Fallout

JP Morgan faces significant legal challenges and reputational damage as a result of its association with Epstein, highlighting the broader implications for the financial industry.

What People Are Saying

Latest Insights and Analyses

Double Shot of Merger Monday

This landmark acquisition not only signifies a powerful union of expertise and resources but also sets the stage for a coffee revolution that embraces the evolving tastes of consumers everywhere. By blending the rich heritage of JDE Peet's with the innovative spirit...

Elon Musk and Trump Fallout

Explore the unfolding saga between Elon Musk and President Trump, where business meets politics in a high-stakes showdown. News From CNBC middayThe relationship between Elon Musk and President Trump has taken a tumultuous turn. Once allies, their interactions have...

AI Will Eliminate Jobs

Explore how artificial intelligence is reshaping the job landscape, particularly affecting entry-level white-collar positions. Understand the challenges and opportunities that lie ahead in this evolving digital era.Recent studies indicate that AI could potentially...

Join the Conversation

We invite you to share your thoughts on the ongoing developments in the JPMorgan and Epstein case. Subscribe to our newsletter for more updates and insights on this and other important topics.